The End of American Prosperity?

Friday evening, I had an interesting conversation. I found myself verbalizing a simple fact I have always known, but was never actually taught. It began with a discussion about how many economists are heralding the end of the recession, while others fear the other shoe is about to drop. The conversation wandered into a rehash of the oft repeated argument about what ended the Great Depression. Liberals are fond of crediting Roosevelt’s New Deal, while Conservatives are fond of crediting the war. Either way the argument being made is that government spending stimulated the economy enough to kick start the economy, thus proof of the validity of Keynesian economics.

As a preface, I am not an economist but I have a business degree and a common-sense understanding of economics. I have sat through many economics and history college classes where the merits of the New Deal and Keynes’ mixed economy were touted and in some cases celebrated. Similarly, I have listened to Conservatives argue that the war ended the Depression. (For a detailed review of the arguments refer to this paper, however note this paper does not necessarily reflect my opinion.) The economic conditions that led to the recovery were rather complex and interrelated. To attribute the recovery to any one set of circumstances seems overly simplistic. Market forces during this time were being influenced by government intervention even as market conditions were being influenced by the spreading war in Europe and Asia.

Balance of Exports

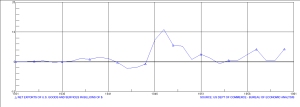

Without writing a lengthy 30-50 page paper on the topic, I’ll cut to the point. Perhaps I’m flying in the face of current economic theory but I believe strongly that a nation’s prosperity is related to its industry and a country that is creating exportable goods is creating real wealth rather than consuming it, (the key word is “real”.) Therefore, I am referring to U.S. Dept of Commerce data in the following observations.

World War II created huge demand for military and consumer goods. As tensions built, leading up to the war we see Industrial production and thus exports increasing. By the time America enters the war, the main focus of industry, world-wide, is war-centric. We see America importing more than it exports. To me this demonstrates that the war did not necessarily cure the economy.

Out of the Ashes of War

But wait, look what happened directly following the war. Exports soar and the economy booms. Why? I believe it is because America emerged from the war unscathed. True, much human capital was spent defeating the forces of evil in both Europe and Asia, but our cities had never been bombed, our factories were intact, our infrastructure pristine, and our workforce was energized. Meanwhile, European and Asian cities were largely laid waste, their industry in ruins, their infrastructure fragmented or non-existent, and their workforce either rotting in their graves or reeling from the shock of war.

In 1946, America was robust and healthy while the rest of the world was starting over. They were in need of everything and only capable of providing resources to obtain what they needed. It worked to the American advantage. America helped rebuild the world in exchange for resources. As a result the United States became the wealthiest nation on the planet, while the rest of the world benefited from American investment and imports. We could argue America was already the wealthiest before the war, but I would counter a similar situation followed WWI.

Where did we go wrong then? In large part when we abandoned the gold standard. Under the gold standard trade imbalances corrected themselves. Without the gold standard, trade deficits seem sustainable, although in reality they are not indefinitely sustainable. That brings us back to the recovering world. Once the Asian and European economies recovered they regained their capacity to compete. Flush with cheap labor and given American know-how, they quickly proved their ability to undercut American Industry. With no way to counter this cheap resource American business decided to take advantage of this resource. Essentially they gave up on American labor and outsourced as much labor as possible to sources of cheap Asian labor.

They could not have achieved this without fundamentally changing U.S. trade policy. They did this by convincing both Democrat and Republican politicians that the best way to save the American economy was to adopt a free-trade policy and then use the World Trade Organization (WTO) to convince other nations to do the same. American companies basically moved their industrial production to the lowest bidder, often importing pieces of products from many sources and then assembling them in the target nation. This allowed them to maximize the cheapest methods of doing everything and avoiding any nasty tax penalties.

Notice the Net U.S. Export 1980-2008 graph. Just as the trade deficit was beginning to improve Free Trade policies are adopted. The American balance of trade take a dive and the U.S. economy transforms from industrial to service. The steel industry gone. Textile gone. Electronics gone. Mechanical gone. Auto soon to be gone. Now environmental policy threatens our agricultural industry, one industry where we still have a trade surplus. But that’s another essay.

The Dollar Standard

Since 1971 the U.S. dollar has been the primary reserve currency. This is due largely to the U.S.’s historically sound fiscal policy, stable political landscape, and the strong economy. The world economy as a result has been locked to America’s economy. So last year when socially engineered banking rules resulted in a bevy of bad bank assets not only did the U.S. economy tank but we took much of the world with us. Even our largest creditor and primary manufacturing vendor, China was impacted.

Since 1971 the U.S. dollar has been the primary reserve currency. This is due largely to the U.S.’s historically sound fiscal policy, stable political landscape, and the strong economy. The world economy as a result has been locked to America’s economy. So last year when socially engineered banking rules resulted in a bevy of bad bank assets not only did the U.S. economy tank but we took much of the world with us. Even our largest creditor and primary manufacturing vendor, China was impacted.

Thus the global trade imbalance, excessive U.S. national debt (currently at $11.8 trillion, estimated to hit $23.2T by 2019 but I predict the number will be closer to $30T), and irresponsible government money creation, threaten the dollar standard. We are looking at the Euro as the heir apparent. What may follow is hyper-inflation as American banks lose foreign capital, foreign credit is likely to be severely curtained, and interest could sky-rocket.

What role Obama plays in all this is debatable. I’m not blaming him per se. That said, as a Representative voting for and defending the social engineering rules of Freddie and Fannie, he certainly contributed to last year’s financial collapse, but in this he was just one cog in a very big wheel that incriminates a host of elected officials. As President his continual diminution of the importance of the United States, his betrayal of long-standing allies, and his capitulations to U.S. enemies cannot be good for economy in the long-term. However, anything that results toward weakening the American economy can only help bring about economic socialization. If indeed this is the aim.

Meanwhile there are some who believe the global economy can only be restored with the advent of a global currency. A global currency would replace the dollar standard. There are already serious forces at work to make this happen. The WDX Organisation has developed a world currency called the Wocu™ (World Currency Unit). This is being introduced on January 1, 2010 as a commercial exchange product with the hope that it “will be of near universal interest to Individuals, Corporations, Financial Institutions and Governments.” The future of the Wocu is questionable but the instrument is well thought out and shows possibilities. I see the Wocu as a reserve currency rather than something we might someday be placing in our wallets.

Ultimately all this likely means a lower standard of living in the United States, perhaps permanent unemployment around 10%, an expanded government role in the economy, and a greatly devalued dollar. The last thing Asian nations want to see is the return of American manufacturing but long-term (and I’m talking decades away) as American wages continue to decline and the divide between rich and poor widens, (yes in spite of Democrat efforts, punitive taxation against the wealthy will most likely result in the destruction of the middle class – someone has to make up for lost profits,) the result could be an American manufacturing revival. After all, all economics are cyclical. Historically, governments have fought against the economic roller coaster and failed. Geithner too will fail. Even the Soviet empire failed.

I’m interested in your opinions. Especially if you’re macro economically inclined.